This is the best user-guide to personal finance I've found, and I've probably read them all. It is certainly the sanest and most level-headed. There are no get rich quick schemes here, just plenty of ways to get rich slowly. Indeed, Get Rich Slowly was the name of author's very popular personal finance blog, which led to this book. J.D. Roth takes the great investing advice of Andrew Tobias in The Only Investment Guide You'll Ever Need, and he summarizes the life-earning wisdom in the previously reviewed (and still recommended) book Five Rituals of Wealth and he includes the needed crystalization of priorities found in Your Money or Your Life, and financial motivations from Suze Orman and the Millionaire Next Door and then adds key insights and tips from hundreds of other lesser-known money gurus.

Basically, Roth has read every book and blog on money managing, investing, saving, and earning and digests and integrates all this hard-won knowledge into an amazing selection of smart, practical ideas for today. I could hardly turn a page without learning a solid investing tip or two, or a clever way to save a few hundred dollars, or an example of something I already knew, but was looking for a vivid way to teach my kids. I like the fact that Roth emphasizes the value of sharing whatever wealth you have, and keeps returning to the long view.

I would not call this an inspirational book (plenty of those on the shelves), nor even a memorable book like the ones mentioned above. Rather it is what is advertised: a day-to-day operating manual for your money. Specific details, sources, methods, tricks. Dip into it when you are stuck, check it before trying something new, re-read it when you think you know it all. I've done pretty well financially, and if you were to ask me my practical advice -- like what to do tomorrow -- I would simply give you this book. It's slow, but true.

-- KK

Your Money: The Missing Manual

J.D. Roth

2010, 336 pages

$15

Available from Amazon

Sample Excerpts:

Because you earn pre-tax dollars but spend after-tax dollars, a penny saved is actually more than a penny earned. Depending on your tax bracket, you might have to earn $111 , $133, or even $150 to put $100 in your pocket. So if you re in the 25% tax bracket, saving $750 a year is like giving yourself a $1,000 raise!

*

Destroy Existing Debt

After you've stopped using credit and created an emergency fund, then go after your existing debt. Attack it with vigor, throw whatever you can at it. The best way to do this is to use a technique called the debt snowball, which lets you build and maintain debt-destroying momentum. Here's the basic method: Make a list of your debts in the order you want to destroy them. (You'll learn a couple of good ways to prioritize debts in a moment.) Set aside a certain amount of money to pay toward debts each month ($500, say). Make the minimum payment on all debts except the first one on your list. Throw every other penny at the first debt on the list. But here's the key to making the debt snowball work: After you've destroyed your first debt, you'll find you've freed up a bit of cash; because one of your debts is gone, you have one less monthly payment. You could take this money and use it for something else, but you re going to do something smarter: keep paying the same total amount, $500 in our example, toward the debt every month.

*

Destroying low-balance debt first

If you've tried following the highest-interest-rate-first advice and still struggle with debt, there's another way. In his book, The Total Money Makeover, Dave Ramsey advocates an approach to the debt snowball that tackles accounts with low balances first. (Ramsey didn't invent this method, but he's popularized it over the past decade.) With this version of the debt snowball, you ignore interest rates when determining the order in which you'll pay off your debts. All you look at is how much you owe, organizing the debts from smallest balance to largest balance.

That's not to say you shouldn't try this method: If it works for you, use it! But if you struggle, consider the next method, which is the one that helped me succeed. It might help you to have a visual representation of your debt-paying progress. Try this: take a piece of graph paper and block off squares to represent your debt. (You might use one square for every $ 100, say.) When you make a payment, mark off a square and give yourself a pat on the back. (If you re a geek, build yourself an Excel spreadsheet that does something similar.) These little progress reports are cheesy, but they can keep you on track.

This method may not be as quick as paying your high-interest debt first, but it provides tremendous psychological reinforcement. You get some quick wins checking creditors off your list that encourage you to keep at it. Dave Ramsey calls this behavior modification over math, and he's right: the most important thing when paying off your debts is to, well, pay off your debts; the order in which you do so is irrelevant. Critics of this approach argue that the math doesn't make sense, and they're right: If you use this method, you will pay more interest than if you had the discipline to pay off your debts based on interest rate. But humans are complex psychological creatures, not adding machines. We usually know what we ought to do, but that doesn't mean we always do it. If we were adding machines and always made the best choices, we wouldn't get into debt in the first place!

*

Second excerpt:

*

Protecting Yourself with Parallel CDs

With a CD, one of the biggest risks is that you'll need to pull your money out before it matures. When you do this, you pay a penalty. The site FiveCentNickel.com suggests that you can decrease this risk with parallel CDs: http://tinyurl.com/parallel-CDs. here's how it works: Let's say you have $5,000 you'd like to put into CDs. Instead of opening a single CD and putting that whole amount in it, you'd open multiple CDs, all with the same maturation date. You could open five CDs of $1,000 each, say, or open two with $1,000 and one with $3,000. This gives you a buffer in case you need to get at the moneyearly. If you need $500 for an emergency, for example, you can break just a single $1,000 CD. That way you don't pay a penalty on the rest of the money you have in CDs, and the penalty will be smaller than what you would have paid if you'd put the whole $5,000 in a single CD.

*

Pay Yourself First

If you're living paycheck to paycheck, saving may seem impossible. You have to pay for things like rent, a car payment, groceries, and maybe even student loans. You'd like to save, but at the end of the month, there's no money left to set aside. And that's the problem: Most people try to save something out of what s left over instead of saving first. One of the best ways to build wealth is to set aside a portion of your income for savings before you pay your bills, buy groceries, or do anything else with yourmoney. Here are three reasons to pay yourself first: It makes you the priority. You're telling yourself that you are more important than the electric company or the landlord. think of the money you put into savings as a down payment on your future. It encourages sound financial habits. Most people spend their money in the following order: bills, fun, savings. But if you bump savings to the front of that list, you can set money aside before you come up with reasons to spend it. That way, since the money is no longer in your checking account to tempt you, you end up spending less.

*

Targeted Savings Accounts

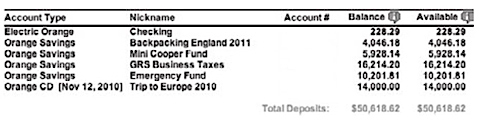

Most people work toward several financial goals at once, but keep their money clumped together in a single account. With that setup, it's easy to forget how much you've saved for each goal and to borrowmoney from one goal to pay for something else. In The Six-Day Financial Makeover (St. Martin's Press, 2006), Robert Pagliarini advocates targeted saving through what he calls purpose-driven investing: Purpose-Driven Investing [lets us think] of each of our goals as a separate basket. Each of our baskets represents a single goal with a clear purpose that we can see and grow. What does this mean in the real world? It means that we have a single investment account for every goal.

If you want to try targeted saving, ask your bank or credit union if you can give your accounts nicknames. My credit union let me name my new savings account Nintendo Wii when I decided to save for that goal. And my accounts at the online bank ING Direct are named for the things I'm saving for, as you can see in the following image:

*

Ramit Sethi popularized the concept of conscious spending in his book I Will Teach You to Be Rich (Workman Publishing, 2009). The idea is to spend with intent, deliberately deciding where to directyour money instead of spending impulsively. Sethi argues that it's okay to spend $5,000 a year on shoes if that spending is aligned with your goals and values and you've made a conscious choice to spend this way.

*

As a general rule, you shouldn't borrow money to buy things that are likely to decrease in value. That means you shouldn't buy your new plasma TV on credit next week, it'll be worth less than you paid for it. Nor should you go into debt to buy food, clothes, or computers. But many experts say that it's okay to take on reasonable debt to pay for a handful of things that are likely to increase in value. This good debt includes an affordable mortgage on your home, student loans to pay for education, and loans to start a new business. Car loans are borderline: they generally carry low interest rates, but as you well know, cars lose value the moment you drive them off the lot.

"

No comments:

Post a Comment