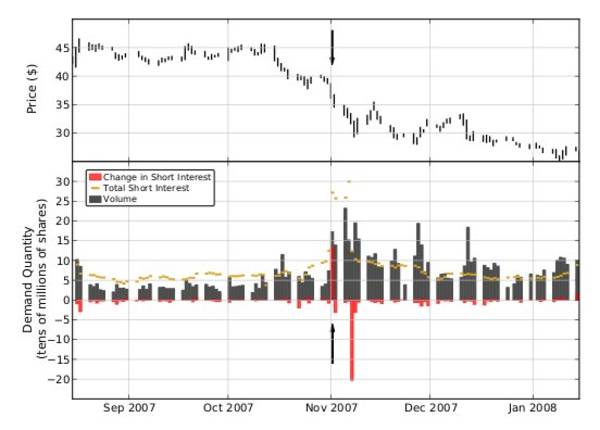

A paper from the New England Complex Systems Institute claims that they have found evidence that traders executed a "bear raid" on Citigroup in 2007, precipitating the financial collapse. A "bear raid" is a market manipulation technique in which short sellers conspire to dump huge quantities of borrowed shares into the market all at once, driving the price down (short selling is a stock-trading technique in which shares are borrowed for sale; the short seller makes money when the value of the borrowed shares declines).

"Bear raids" have been considered a risk to markets since the Great Depression, and a financial regulation called the "uptick rule" was instituted in 1938 to prevent the tactic. The uptick rule was repealed in in July, 2007, and the alleged bear raid took place in November, 2007.

On November 1, 2007, Citigroup experienced large spikes in short selling and trading

volume. The number of borrowed shares—short interest—increased by approximately 130

million shares to 3.8 times the 3-month moving average. The total trading volume jumped

from 73 million shares on the previous day to 171 million shares, 3.7 times the 3-month

moving average. The ratio of the increase in short positions to volume was 0.77. This is the

fraction of the total trading that day that may be attributed to short positions held until

market closing. The total value of shares borrowed on November 1 was approximately $6.07

billion. Adjusted for the dividend issued on November 1, 2007, Citigroup stock closed on

November 1 down $2.85 from the previous day, a drop of 6.9%.

The number of positions closed on November 7, 202 million, was 53% larger than the

number opened on November 1. The short interest before the increase on November 1 and

after November 7 are virtually identical, the larger decrease corresponding to an additional

increase in short interest between these dates. The mirror image one-day anomalies in short

interest change suggest that the two are linked. We can conservatively estimate the total

gain from short selling by multiplying the number of short positions opened on November 1

by the difference between the closing price on November 1 and closing price on November 7

($4.82), which yields an estimated gain for the short sellers of $640 million.

Evidence of market manipulation in the financial crisis (PDF)

(Thanks, Dan!)

No comments:

Post a Comment